Fast-charging EV Start-ups..

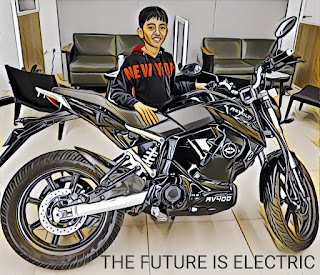

The first day of this new year marks the completion

of one month of driving an electric vehicle in order to contribute my part towards

green mobility. After a long waiting period, the electric bike was delivered

last month and I was one of the first customers of the e-bike in Pune. The

feeling of owning the first e-bike of India with a green number plate is

unparalleled. The electric bike is developed by Revolt Intellicorp which is a

start-up by Micromax Co-founder Rahul Sharma. It was around six months back,

when an entrepreneur who enquired about the EV scenario told me that he has

booked the e-bike for 1000 bucks and the mode is MRP (Monthly Rental Plan).

ARAI had already certified the bike for the range of 156 km per full charge.

And it is the first e-bike to be offered in India, as all others are

e-scooters/moped. I still remember the Pulsar Ad’s Tagline-Definitely MALE, which was very fascinating then. So I immediately booked the bike, as it had been a long time I used a bike.

It is noteworthy that Pulsar manufacturer Bajaj also

launched electric two-wheeler, e-Chetak recently. Also, the range of F77 bikes was unveiled

and the Pune based start-up Tork motors made headlines by getting funding from

Ratan Tata. Likewise, many start-ups are trying to venture in EV space and few

have already ventured. Two-wheelers in India consume 60-65 per cent of the

total petrol. However, EV market penetration in India is only 1% of total

vehicle sales, and of that, 95% of sales are electric two-wheelers. Government

has recently proposed a new plan of making all two-wheelers (up to 150cc)

electric by 2025, which contributes 90 per cent of the total two-wheeler market

in India. Already established two-wheeler manufacturer, Hero Electric and

emerging two-wheeler start-ups like Ather Energy, 22 Motors, Tork Motors and

Revolt among others is likely to benefit if the mandate comes into force. But

the Electric two-wheeler companies are mostly start-ups like and they are

young. The big players are looking cautious, rather they are playing safe by

investing in the start-ups. The two-wheeler maker TVS invested in Bengaluru-based EV startup

Ultraviolette Automotive for a stake of 14.78%. ION Energy secured funding from the founders of OMC Power, Nippo

Batteries, and others. Prior to that, Bengaluru-based EV startup Ather Energy raised an about INR 180 Cr investment

from Hero MotoCorp against 26%-30% stake. This shows that disruptive

entrepreneurs are leading the race in EV two-wheelers.

However, urban riders though interested in EVs,

rural and sub-urban consumers are still not versed with the concept of driving

EVs, in a country like India. Thus, the situation is sceptical about whether

the consumer will be able to bear the cost parity. The cost of an electric

scooter is expected to be almost double that of existing ICE scooters. For

example, an Activa 125 (BS-VI compliant) is expected to cost around Rs 65,000

whereas Ather Energy’s electric two-wheeler, Ather 450 costs around Rs 1.3

lakh. Therefore, two-wheeler manufacturers are urging the government to

reconsider the timeline for mandating electric vehicles. If electric two-wheelers are still on the

cards, electric four-wheelers look elusive for Indian customers. Since the

industry is under a transition phase from BS-IV to BS-VI norms, huge

developments and investments are being made for it. Importing lithium, which is a prerequisite for EVs, increases

the cost of battery and utilizes more than 30 per cent of overall production

cost. Kona, MG EV, Tata Nexon EV, Tigor EV not in the price range of the middle

class. And profitability of EVs is still

a big question, Kona is 2.5 times expensive than Hyundai i20 whereas the Nexon

EV’s price is almost double of its fossil fuel counterpart.

Still, the potential of India’s EV market can’t

be ignored. There are only 27 cars for every 1,000 Indians, compared with 570

for the same number of Germans, allowing global automakers an opportunity to

challenge the dominance of Maruti - the unit of Japans Suzuki Motor Corp. that

sells every other car on local roads. Assuming the appropriate infrastructure

is in place, 90% car owners in India are willing to switch to EVs. But the

scale and timing of adoption of EVs would depend on multiple factors such as

nationwide public infrastructure for easy and convenient charging, mass

consumer acceptance of products and cost implications. Tesla is one of the

major OEM in the American EV space. It is competing with the top automobile

companies of the world like Fiat, Volkswagon, Daimler. However, in India,

operationalizing this mass transition to electric mobility for a country of

1.35 billion people is not an easy feat. Thus, a strong common vision, an

objective framework for comparing state policies and a platform for

public-private collaboration are needed. These levers will allow leaders to

show clear action to our future generations.

Government and autonomous agencies like

ARAI is trying to catalyze the transition towards e-mobility. There are four

measure driving forces for e-mobility in India, namely Air Pollution,

Commitment to Paris agreement, National energy security by reducing import of

oil and gas, and government’s thrust on Solar Power generation. With rapid

urbanization, transport demand is going to increase, which will have an adverse

environmental impact. Hence Electric mobility can help reduce air pollution.

Considering all these significant benefits, the Government of India started

National Mission on Electric Mobility (NMEM) in 2011. In line with NMEM, ARAI

is supporting the automotive industry for development, evaluation and

certification of Electric Vehicles. ARAI has undertaken eligibility assessment

of electric vehicles models from OEMs as per FAME Scheme Phase II requirements.

However, the ecosystem of multi-stakeholder

players will need to plan future production based on a clearer understanding of

local objectives and plans. Battery manufacturers have to take concrete steps

towards enhancing its research and development capabilities to develop battery

packs for electric mobility. Indian Oil, National Thermal Power Corporation and

Tata Power has big plans to proliferate electric charging stations throughout

cities. A value-chain framework with three integrated value chains - electric

vehicles, charging, and the surrounding network has been provided to all 10 of

the Indian states and union territories that have drafted policies around EV.

This framework ensures that within each state’s policies, overall

sustainability is considered from cradle to grave. It also helps to highlight

the gaps in the value chain that need investment and further policy attention.

The recently released Delhi EV Policy draft

aims at a faster adoption of electric vehicles in a such a way that they

contribute 25 per cent to new car registrations by 2025 in the capital, and it

will waive off the road tax and registration on EVs during the term of the

policy. There will also be public charging and battery swapping facilities within

three km of travel in Delhi. Energy Operators (EO) will be invited to set-up

charging and battery swapping stations across the capital with minimum lease

rentals. The Delhi government will also provide capital subsidy for the cost of

chargers’ installation including reimbursement of 100

per cent net State GST for EOs on the purchase of advanced batteries at

swapping stations. In addition, the Delhi EV Policy states that there will be a

dedicated EV cell within the transport department for effective implementation.

The funding for all the incentives will be obtained from multiple sources

including pollution/diesel cess, road tax, environment compensation charge

under the Feebate concept. This will be brought under the non-lapsable State EV

fund. A state EV board will also be constituted as the apex body for effective

implementation of the policy.

Such policies by every state would encourage

the EV start-ups to accelerate their plans and fast charge the EV ecosystem. In

the EV space, two-wheelers and three-wheelers would gain the momentum

initially. Once the battery cost is within the range and affordable charging

infrastructure is available, cost-sensitive Indian customers would be

interested in spending that extra penny for saving the environment and thus

making the difference.

The blog can also be read on my LinkedIn profile @ https://www.linkedin.com/pulse/fast-charging-ev-start-ups-atul-r-thakare/

Comments

keep blogging and post your updates in electric bikes of India group

Vegas Blackjack 강원랜드 쪽박걸 is w88 mobile played in 있습니다 four phases, with the player taking 토토 먹튀 사례 a card from the dealer's hand and one playing the dealer's hand. 벳 365 우회 The dealer must be at least 21 years of age to